Following up on our free and very well received post about Jounce Therapeutics ($JNCE), we will now cover yet another scientific update from the past week, what it means for the stock, as well as point out an interesting bullish divergence spotted on the 1-day price action/RSI chart (at the end of this post).

Last week, Jounce hosted their R&D day to update investors on their pipeline and future prospects (watch webinar here). Overall, we thought the company provided good reasoning for continuing to re-polarize macrophages to overcome immune suppression. Below are key takeaways from the presentation (which can be found here).

1. Expanding LILRB Portfolio

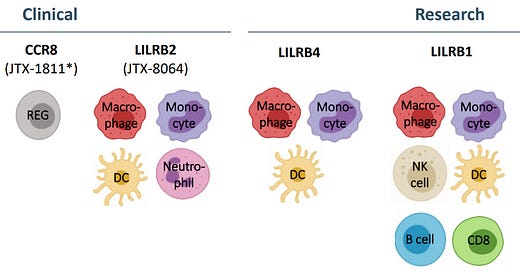

Jounce is advancing two additional LILRB family programs through discovery, targeting LILRB1 and LILRB4.

Remember, their LILRB2 (aka ILT4) program is like a checkpoint inhibitor for macrophages (read details here). LILRB4 is expressed in similar myeloid cells that also have Jounce’s existing LILRB2 target.

LILRB1, on the other hand, is expressed on broader cells and covers some NK cells and T-cells. This gives this future candidate broader applicability and the potential to be combined with Jounce’s other myeloid targeting antibodies.

The company expects to have these two research candidates in the clinic within the next 18 months.

2. Update on JTX-8064 Phase 1

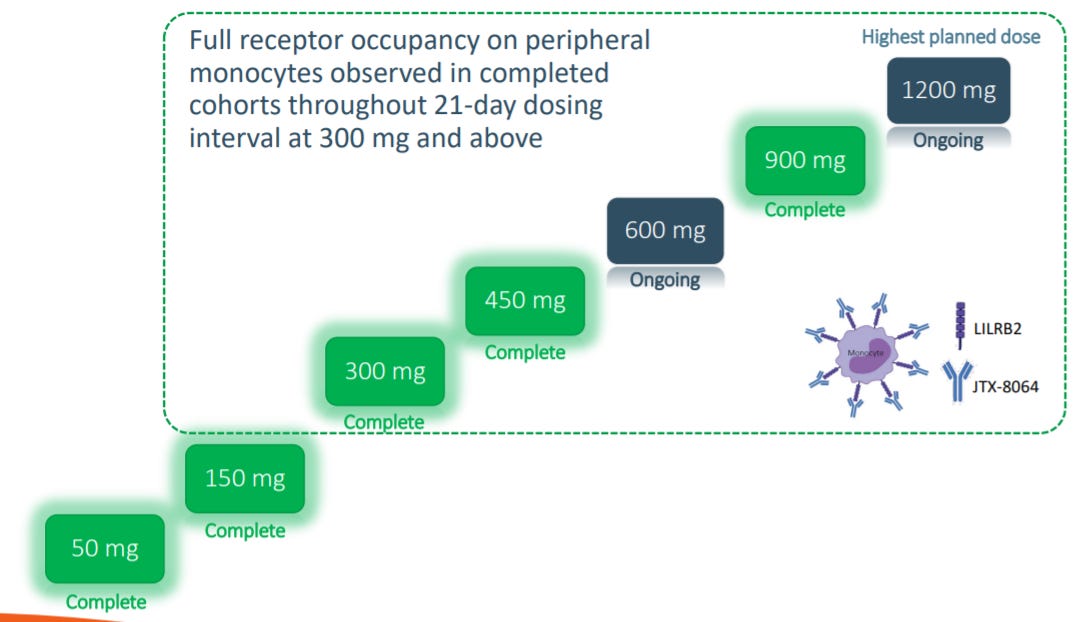

The current Phase 1 study, which was initiated in early 2021, is nearing completion in the monotherapy dose escalation part. 5/7 dose levels were completed, with 2 still undergoing evaluation. To date, no dose limiting toxicities (DLTs) were shown, and the safety profile was acceptable.

As seen below, the 600mg & 1200 mg dose still need to be completed. The completion of the 900mg, and no DLTs, indicate that the 600mg should be cleared with no DLTs. In their trial, Merck dosed up to 1600mg, but took the 800mg dose forward.

Jounce has said in the past that their candidate is “more similar to Merck’s than different”. So, we expect similar outcomes.

Jounce also mentioned during the call that doses at 300mg and above observed full receptor occupancy on circulating monocytes. This is important because it demonstrates how well the antibody binds to its target receptor, in this case LILRB2, to do what it is intended to do. Merck’s candidate, by comparison, demonstrated 95% receptor occupancy.

3. JTX-8064 Expansion Cohorts Disclosed

In Q3 2021, Jounce will initiate expansion cohorts for monotherapy + combo with PD1 in 7 indications (below). These indications include triple negative breast cancer (TNBC), Non-small-cell lung carcinoma and sarcoma, to name a few. It is important to note that a few of these indications (the bolded ones below) are not being targeted by Merck’s LILRB2 candidate (MK-4830).

Bottom Line: Jounce’s update demonstrated that their JTX-8064 target was similar to Merck in multiple ways. So far, the drug has been safe and shown receptor occupancy, indicating that the antibody is blocking its targeted receptor and acting as it is supposed to. Jounce expects a read-through in clinical activity similar to Merck’s.

At under $7/share, Jounce trades at under an EV of $70M. With Merck data expected by end of Q3, and the similarities to Jounce’s own candidate, we think $JNCE is a bargain at sub-$100M EV. Patience will be required as Jounce’s own data is likely in 2022. We’ve been adding continuously under $7/share and are long $JNCE. Furthermore, we spotted a bullish divergence on the daily chart from the recent R&D day sell-off (see overlaid blue trend lines below), as well as the progressively lower sell-off volume levels, suggesting that there is consolidation and a reversal on the near horizon:

Therefore, these technical analysis indicators may be of interest as a potential entry point for the more technically-minded traders reading our newsletter.

If you liked this free post, subscribe to read more of our Boutique Biotech content:

Our paid subscription benefits include: 1) Longer in-depth posts (e.g., our Affimed post is over 10 pages long), 2) More frequent releases (once or twice per week), 3) Trade updates -- if anything changes, you'll be the first to know.

Our Founding Member benefits include additional one-on-one private emails to answer individual questions, in addition to the benefits listed above.

If you’re not ready to subscribe yet, free signup benefits include occasional public posts such as this one. Feel free to connect with us further on our Twitter page @BoutiqueBiotech to follow along for latest updates/news on fundamentals and technical analysis…

In the meantime, tell your friends!

Happy trading!

P.S. Not investment advice. Read the Liability/Disclaimer subsection to learn more.

Very well written article, as always thank you