Jounce Therapeutics (JNCE) is developing a macrophage checkpoint inhibitor that can unleash a two-pronged cancer-killing approach that leverages T-cells and macrophages. Last year, Merck validated this target with Phase 1 data that demonstrated it can reverse resistance to PD-1 (details below). This is a multi-billion-dollar space on par with the bestselling cancer drugs Keytruda & Opdivo. We believe that 2021-22 will be the year that the immuno-oncology field catches on to macrophages as a combination therapy. If this thesis transpires, Jounce will be a main beneficiary of the increased interest in the ILT4 space. Specifically, Jounce is developing an ILT4 antibody that can unleash the cancer-killing effect of macrophages. Combining this checkpoint inhibitor with anti-PD-1 creates a two-pronged attack (macrophages + T-cells) that has multi-$billion sales potential.

PD-1 Checkpoint Inhibitors & Finding the Next Breakthrough

Anti-PD-1 & anti-PD-L1 inhibitors (such as Keytruda, Opdivo and Tecentriq) have become the backbone of immunotherapy by blocking the evasion technique that cancer cells use to manipulate the immune system.

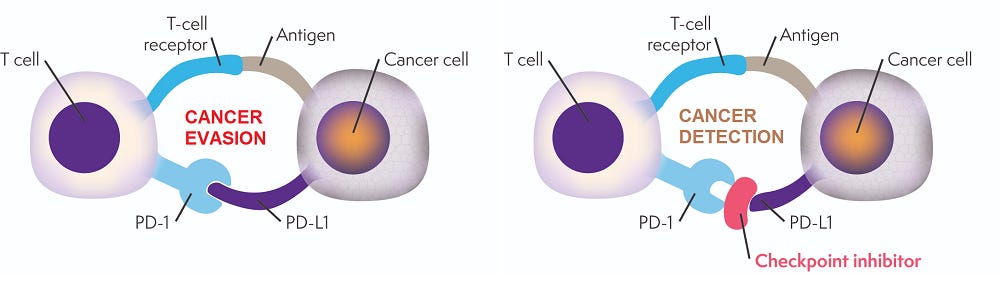

Immune cells (such as T-cells) have inhibitory receptors on their surface that act as “off-switches”. When these receptors are bound, they turn the immune cell off. PD-1 is an example of an inhibitory receptor found on T-cells.

Cancer cells also have receptors on their surface. When the receptors of both T-cells and cancer cells bind, the cancer cell communicates with the T-cell. PD-L1 is a receptor found on cancer cells that binds to PD-1 on the T-cell. This binding turns the immune cell off and allows the cancer cell to go undetected (left image below).

Checkpoint inhibitors work by blocking the PD-1/PD-L1 binding and thereby blocking the repressive communication between the T-cell & cancer cell. This allows the T cells to recognize the cancer cells as abnormal and attack them (right image).

This PD-1 & PD-L1 pathway has made Keytruda & Opdivo $10B franchises for Merck and Bristol-Myers Squibb. However, in many solid tumors, PD-1 & PD-L1 blockade therapy is only effective in a small proportion of patients (approx. 30%). Most patients do not respond to anti-PD-1 therapy because of resistance. Think of resistance as genetic changes that cancer undertakes to avoid immune system detection.

Drug developers are now looking at other ways to block this repressive communication between cancer cells and immune cells. Their thesis: blocking multiple inhibitory receptors simultaneously has the potential to increase the immune system’s anti-tumor activity even further. Or, simply put, two is better than one.

Bottom Line: Anti-PD-1 drugs have been a breakthrough in solid tumors and created $10B drugs like Keytruda/Opdivo. Most patients, though, do not respond to these drugs, or relapse after treatment. The pharma industry is now looking for other approaches to combine with PD-1 checkpoint inhibitors to overcome resistance and enhance responses.

ILT4 As A Backdoor Approach to Overcoming PD-1 Resistance

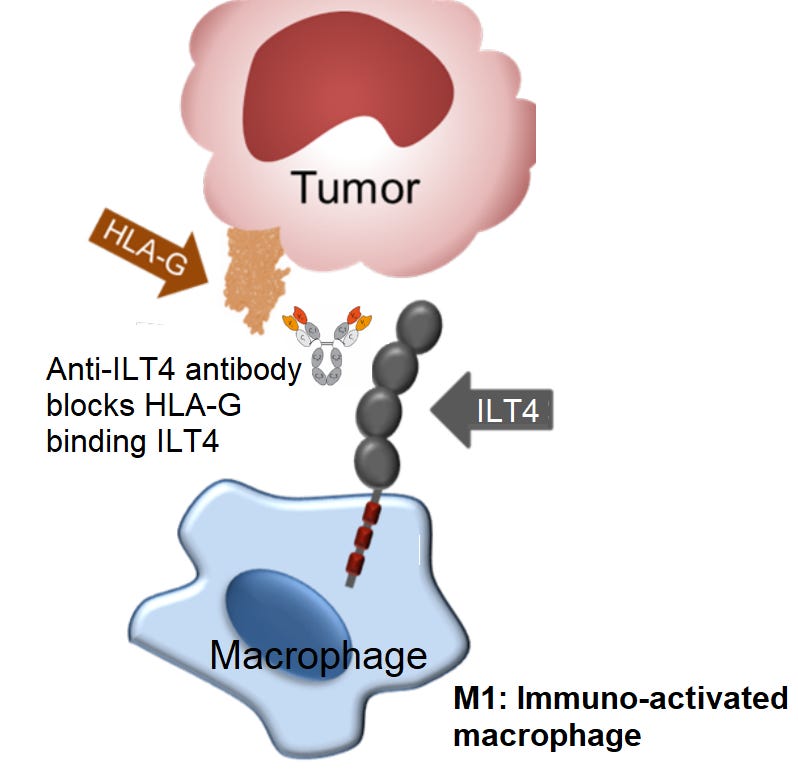

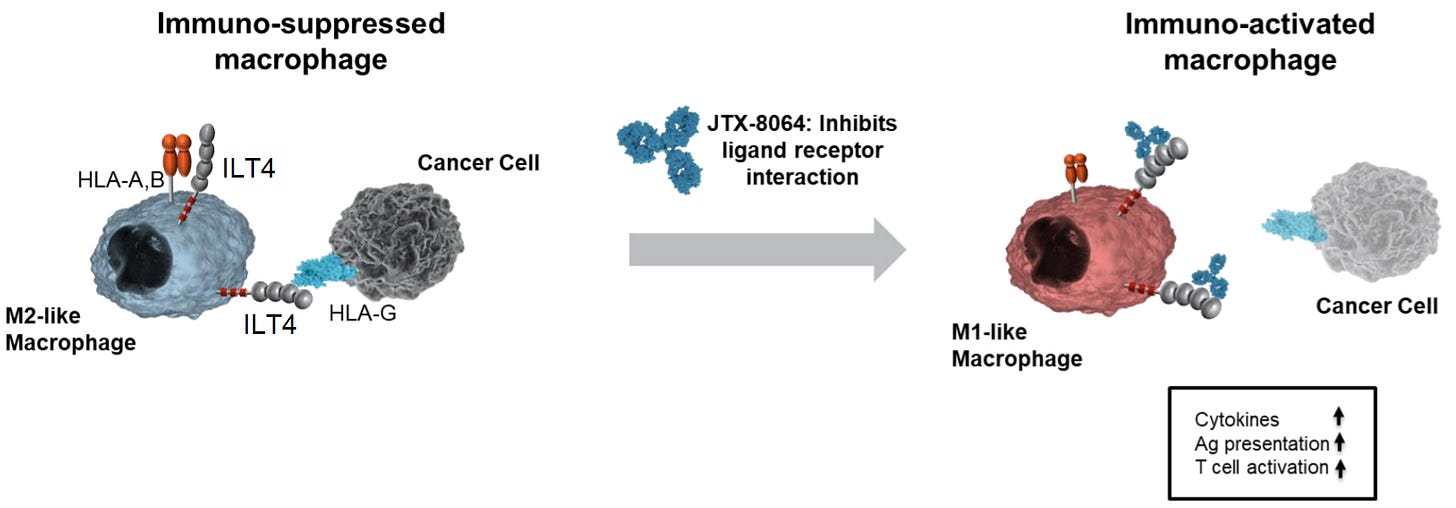

ILT4 (also known as LILRB2) is an inhibitory receptor expressed on macrophages. When ILT4 binds to HLA-G expressed on tumor cells, macrophages are turned off and not able to detect the tumor. This mechanism works similarly to PD-1 & PD-L1 above, except with macrophages instead of T-cells.

This immuno-suppressed state is called an “M2” state (see image below).

A checkpoint inhibitor (antibody) can stop this disabling bind for macrophages, so that they are able to detect the tumor. Again, similar mechanism to anti-PD-1 antibodies discussed above. An anti-ILT4 checkpoint inhibitor blocks the “off-switch” for macrophages. This blocking shifts macrophages to an activated state, called M-1, where they can attack the tumor and recruit T-cells to the tumor site (image below).

Bottom Line: The ILT4 pathway for macrophages is akin to PD-1 for T-cells. Inhibiting both pathways with antibodies would activate a two-pronged attack that uses macrophages and T-cells. This presents a promising backdoor approach to overcoming resistance that limits existing PD-1 checkpoint inhibitors.

Latest updates

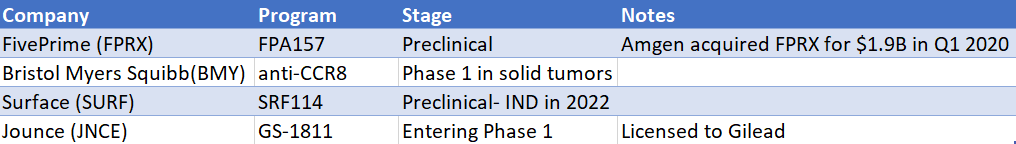

Earlier this week, JNCE received a $25M milestone payment from Gilead (GILD) for advancing their anti-CCR8 antibody through IND clearance. Gilead will now develop this program, called GS-1811, through the clinic.

The collaboration with Gilead was signed back in Sept 2020 and came with an upfront $85M and $35M as equity investment. With the $25M milestone received yesterday, Jounce will have made 145M from the Phase 1 ready candidate. Jounce may receive an additional $660M in future milestones.

CCR8 Target Gaining Interest

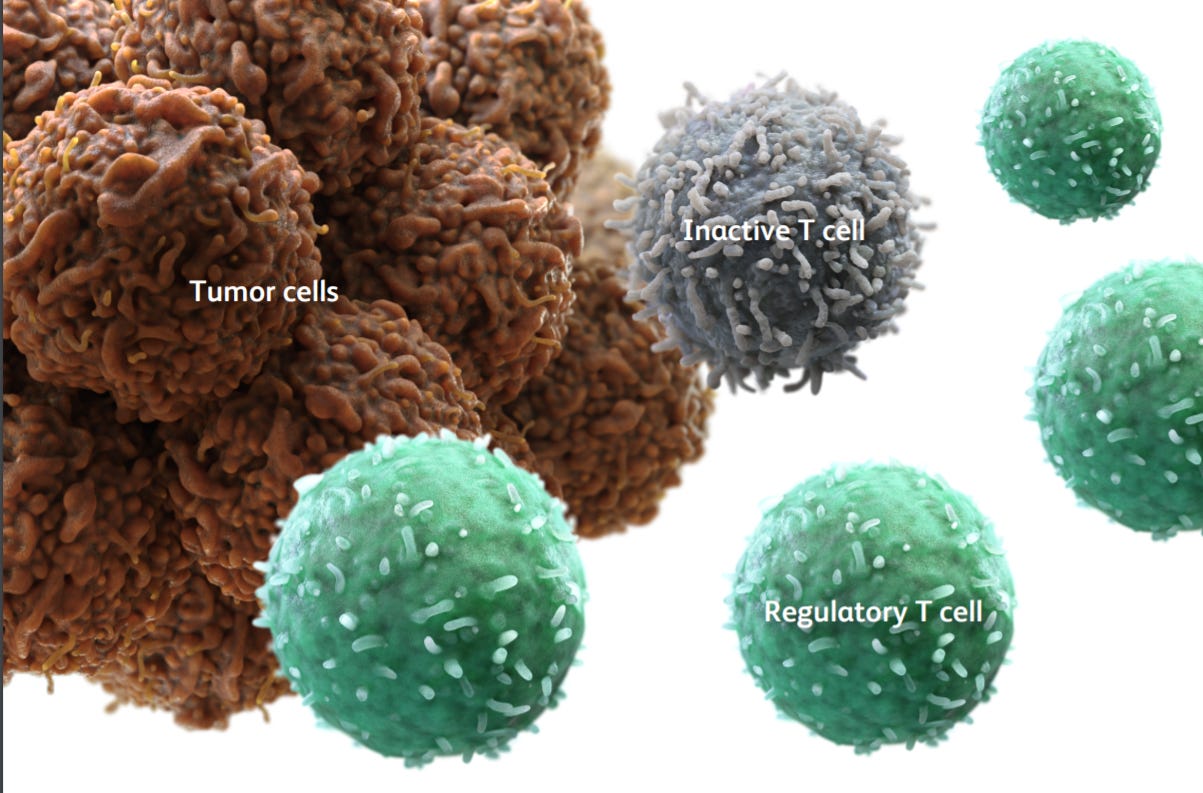

Big pharma interest has been continuing in regulatory T-cells (Tregs). Tregs suppress other cells in the immune system, such as cancer-killing T-cells, to ensure the body does not go into overdrive.

CCR8 is a receptor expressed on immunosuppressed Tregs, which causes them to deactivate T-cells and ignore cancer cells. In other words, cancer uses CCR8 as an evasion tool.

Antibodies are being developed to target CCR8. The idea being that depleting Tregs with CCR8 will boost the immune system and increase the body’s cancer-killing abilities. So far, big pharma has expressed interest in this early target.

Jounce now has approximately $300M in cash and 52M shares outstanding. The company has continued trading lower and now trades at an EV of sub-$100M, and with enough cash on hand to fund the next 24+ months.

The company has two promising billion dollar targets: CCR8 and ILT4. The CCR8 program has been licensed to Gilead. ILT4 will have initial safety data in late 2021. The bigger near-term catalyst is an update from Merck’s ILT4 program, likely in September at ESMO 2021. Merck has already provided proof-of-concept data that shows ILT4 can provide a promising backdoor approach to activating macrophages and overcoming resistance that currently limits PD-1 checkpoint inhibitors. Read on for details on this below:

Merck’s Anti-ILT4 Antibody Validates the Macrophage Combo Approach

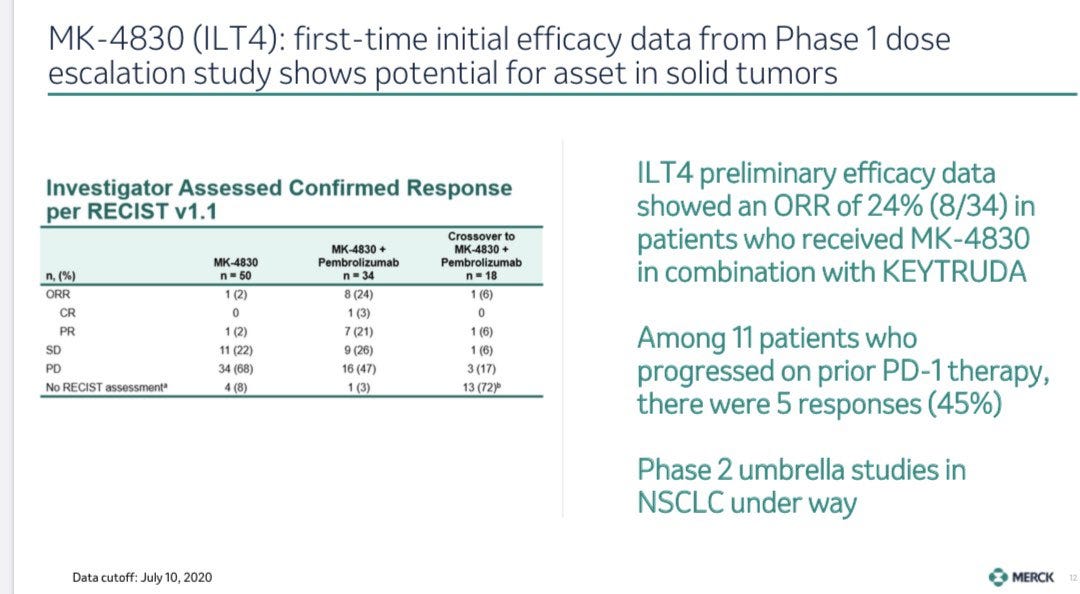

At ESMO in September 2020, Merck released Phase 1 data for MK-4830, their anti-ILT4 antibody. The candidate was tested as a monotherapy (n=50) and in combination with Keytruda (n=34) in advanced solid tumors. This patient population was heavily pretreated, with 50% of patients receiving 3 or more prior lines of therapy (surgery, chemo, radiation, PD-1, etc.)

Preliminary efficacy data showed an ORR of 24% (n=8/34) in patients who received MK-4830 + Keytruda (image below). Merck data did not break down responses for specific tumor types, which makes conclusions difficult to arrive to. Generally, 2nd/3rd line options after PD-1 failure, like chemo/radiation, offer responses in the 20% range. These salvage therapies are also accompanied with nasty side-effects. MK-4830, on the other hand, was relatively clean with the majority of adverse events classified as Grade 1&2.

Importantly, of the 11 patients that had received a prior PD-1 therapy, 5 saw a response (5/11 or 45%). 3 of these patients had not previously responded to anti-PD-1 therapy (resistant) and 2 had progressed on prior anti-PD-1 therapy (relapsed). This is suggestive that ILT4 can reverse resistance to PD-1, an important signal that the mechanism of action (T-cell + macrophage) discussed above can work.

Remember, most PD-1 checkpoint patients do not respond to therapy because of resistance. This Merck study gives hope that adding macrophage checkpoint inhibition can add a second layer of attack. Immuno-activated M1 macrophages can recruit T-cells, enhance tumor killing of the immune system and potentially restore PD-1 inhibitor responsiveness.

Merck saw enough promise in the study to upsize the trial 4x from the original 70 patients to 290, expanding from 3 cohorts to 12. We think that Merck will give another update on this program at ESMO 2021, scheduled for September 16-21.

Bottom Line: ITL4 + PD-1 antibodies, in theory, activate both macrophages and T-cells to attack tumor cells. Merck’s early Phase 1 data supports this notion. What makes it even more impressive is that responses were seen in a heavily treated patient population (3 or more prior lines). Merck upsized the trial 4x to continue accumulating data.

Jounce’s ILT4 Antibody Exhibits Similarities to Merck’s

Jounce is the only other publicly traded company with an ILT4 antibody and is one of three companies targeting this pathway. Merck is the leader with ongoing Phase 2, Jounce is second with Phase 1 initiated December 2020 and Immune-Onc (private) initiating their Phase 1 in the first half of 2021.

In preclinical models, Jounce’s JTX-8064 has shown to bind with high affinity to ILT4. In order for the antibody to block the inhibitory pathway, it must out-compete HLA-G for binding ILT4. This way, the ILT4 receptor binds to the antibody, instead of binding to the HLA-G on cancer cells. A blocked inhibitory receptor allows the macrophage to be in an immune-activated M1 stage (right part of image).

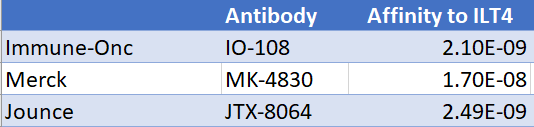

JTX-8064 Has Stronger Binding Affinity

We compared the binding affinity (KD) of each ILT4 antibody below. Remember, the smaller the KD value, the greater the binding affinity. The larger the KD value, the weaker the target molecule and ligand are attracted to and bind to one another.

Merck’s MK-4830 had the weakest binding out of the three candidates at 1.7 e-8 KD. JTX-8064 binds approximately 7x tighter than Mk-4830 at 2.49e-9. Merck claims that their antibody binds ILT4 more than 600x tighter than cancer ligand HLA – G. This would make JTX-8064 bind 4,400x tighter to ILT4 than HLA-G.

Bottom Line: Jounce’s candidate has demonstrated a stronger binding affinity to ILT4 than Merck’s antibody (appox. 7x tighter). Merck, with a weaker binding antibody, demonstrated the potential to overcome PD-1 resistance with responses in heavily pre-treated populations. JTX-8064 has the potential to do the same, and possible better.

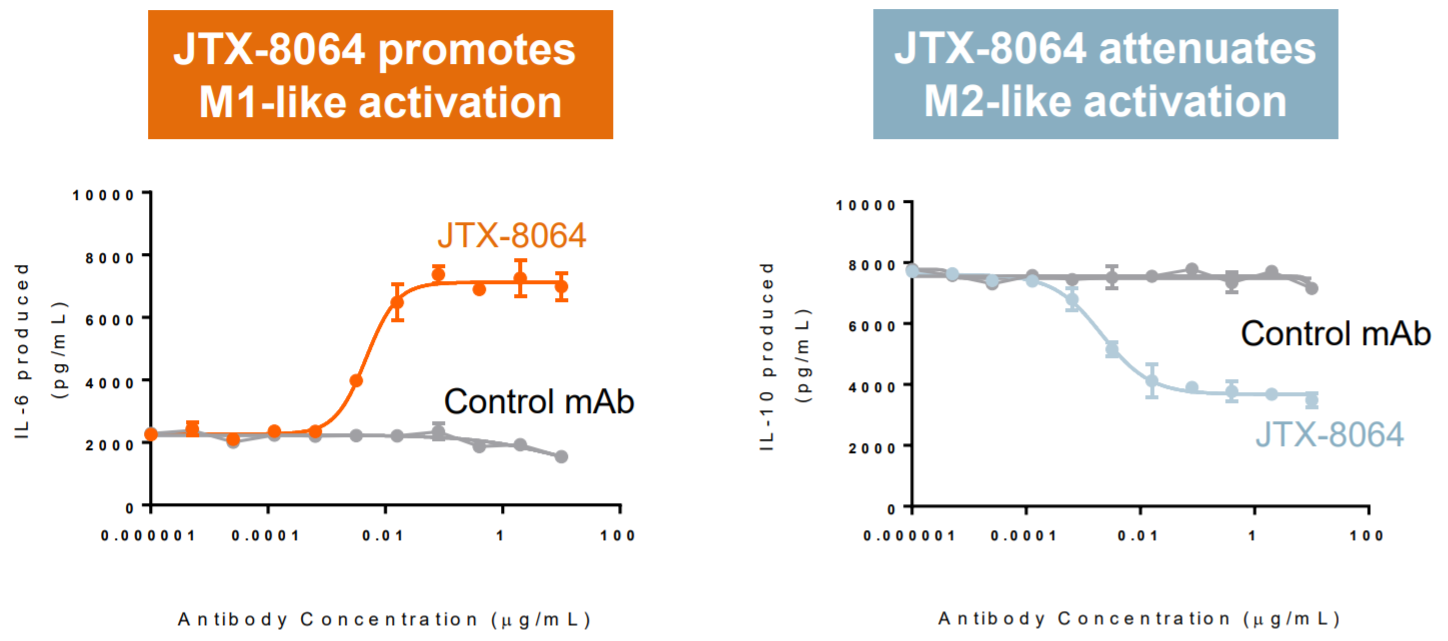

Promotes Macrophage Activation & Reduces Anti-Inflammatory Macrophages

Macrophages are like a double-edged sword; they can be activated to be pro-inflammatory or anti-inflammatory. The cancer fighting stage is pro-inflammatory (called stage M1), while the anti-inflammatory (called stage M2) is immune-suppressive and used for other functions like wound healing or tissue repair. In cancer, macrophages in M2 are not able to detect tumors, and therefore useless in attacking the cancer.

An antibody that can convert macrophages from M2 to M1 would promote cancer killing. CD47 antibodies have shown this and caught the attention of big pharma and Wall Street (Gilead/Trillium/ALX Oncology). Likewise, Jounce’s antibody has shown the ability to activate the cancer-killing M1 stage macrophages and reducing the M2 stage.

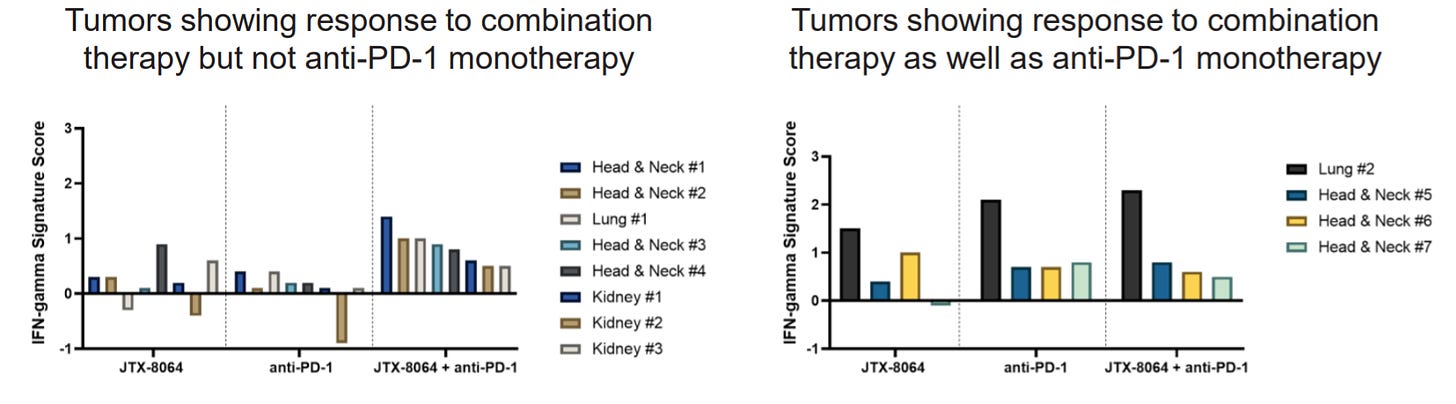

Cancer Tumors Treated with JTX-8064 + anti-PD-1 Show Better Response Than Anti-PD-1 Alone

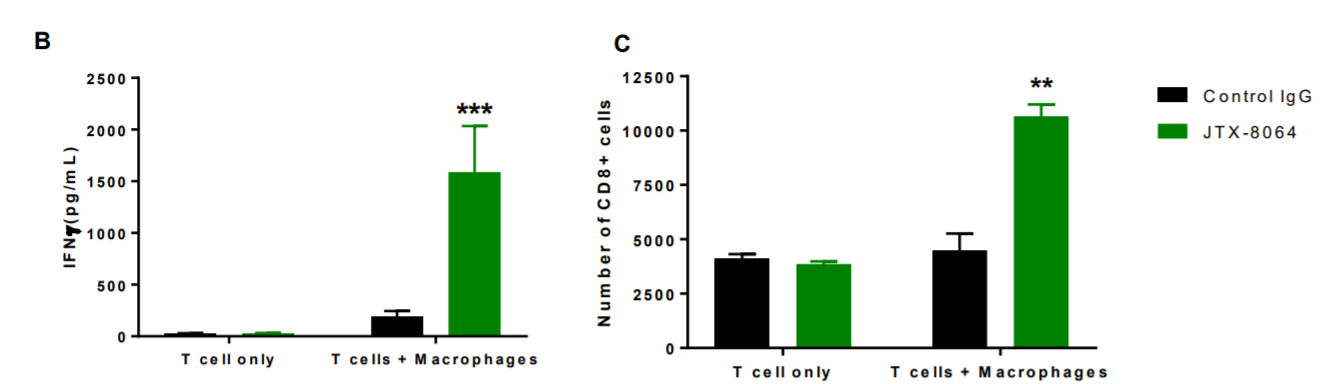

Preclinical, ex-vivo tumor models treated with Jounce’s antibody + anti-PD-1 showed better results as a combination than monotherapy. This validates that inhibiting two pathways yields better results than one or the other, individually. IFN-gamma is a signal of immune response and shows that T-cells and other immune cells are activated and attacking.

Jounce’s Phase 1 was initiated in December 2020. The trial will test JTX-8064 in 40 solid tumor patients (naïve and resistant to PD1) as a monotherapy and in combination with a PD-1 inhibitor. First look at data will likely come in early 2022.

Alternate Pathways Have Caught Billion Dollar Valuations

When Merck combined PD-1 with TIGIT, all smaller TIGIT players rose with the tide. TIGIT is another inhibitory receptor that turns off T-cells. Arcus (RCUS) landed a $375M deal from Gilead and valuation jumped to >$1B.

Similarly, when CD47 was shown to act as a checkpoint inhibitor for macrophages, all companies in the space were beneficiaries. Gilead acquired FourtySeven for $4.9B. Trillium (TRIL) jumped 10x to >$1B. ALXO rose 4x from IPO price to $3B.

We think the ILT4 pathway has comparable characteristics and upside. The pathway works as a checkpoint inhibitor for macrophages and has shown to reverse PD-1 resistance, albeit it in early Merck Phase 1.

In addition to JTX-8064, Jounce has two other candidates. JTX-1811 is a preclinical candidate licensed to Gilead, from a September 2020 deal that netted Jounce $120M upfront. The other program, vopratelimab, has reported disappointing data in non-small cell lung cancer. We are focusing on the ILT4 candidate.

What Needs to Happen for $1B Valuation

Jounce is a name that will piggyback off Merck’s ILT4 program. Merck will provide an update likely in September at ESMO 2021 (~9 months out). Jounce’s own data is >12 months out. During 2020, interest in alternate pathways, or myeloid cells (like macrophages) may catch on. That is the thesis here; ILT4 catching on and Jounce being a beneficiary.

Jounce will report initial safety data for ILT4 candidate late 2021. The bigger near-term catalyst is an update from Merck’s ILT4 program, likely in September at ESMO 2021. Merck has already provided proof-of-concept data that shows ILT4 can provide promising backdoor approach to activating macrophages and overcoming resistance that currently limits PD-1 checkpoint inhibitors. We discussed the details above.

Also, at AACR this year, Jounce presented pre-clinical data further supporting this macrophage activation approach. They showed that patients that do not respond to checkpoint inhibitors have higher ILT4 levels. Therefore, blocking this “off-switch” with an ILT4 antibody would shift macrophages into an active, cancer-killing state. This is represented below in the JTX-8064 bars, which show greater immune response (IFN-gamma) and higher number of cancer-killing T cells + macrophages.

With Merck data 4 months out and Jounce’s own data about 7 months out, there are no near term catalysts. This might cause the stock to fluctuate in the near-term.

JNCE is a bargain at sub-100M EV, but patience will be required here. Boutique Biotech has been adding under $8/share.

If you liked this free post, subscribe to read more of our Boutique Biotech content:

Our paid subscription benefits include: 1) Longer in-depth posts (e.g., our Affimed post is over 10 pages long), 2) More frequent releases (once or twice per week), 3) Trade updates -- if anything changes, you'll be the first to know.

Our Founding Member benefits include additional one-on-one private emails to answer individual questions, in addition to the benefits listed above.

If you’re not ready to subscribe yet, free signup benefits include occasional public posts such as this one. Feel free to connect with us further on our Twitter page @BoutiqueBiotech to follow along for latest updates/news on fundamentals and technical analysis…

In the meantime, tell your friends!

Happy trading!

P.S. Not investment advice. Read the Liability/Disclaimer subsection to learn more.